The complete automated compliance audit experience

The AI RegTech platform, empowering governance, risk and compliance data and management intelligence whilst reducing compliance costs and time. MO® offers regulatory benchmarking diagnostics to assess professional practice against all relevant regulations providing automated gap analysis, audit reports and tailored strategies and automated audit and Consumer Duty Board reports to enhance compliance performance against FCA all relevant directives.

MO provides instant, benchmarked, and heat-mapped GRC dashboards with alerts, insights, and tailored resources to improve your scores.

MO integrates with third-party software such as back office / CRM to provide real-time, streamlined data and regulatory dashboard reports, automate audit activities, and continuously update the governance, risk, and compliance diagnostic platform.

MO regularly and provides instant alerts, so that your business can keep track of new regulatory requirements, relevant regulatory directives and papers and our good practice benchmarks.

Learn more about your firm’s compliance performance

The purpose of the diagnostic is to encourage holistic and strategic thinking, and benchmark the firm’s performance against professional good practice and learn more about your personal view of the firm’s performance in the six key regulatory areas.

Your Focus

Strategy, governance, key financial ratios and managing risk – How well you are leading the business through key business functions, individual, systemic, and cyber-risks and regulatory directives

Your Engagement

Client and stakeholder engagement – How has your brand’s presence, marketing plan and documentation supported the client journey, embraced digital design, and involved key stakeholders

Consumer Duty

Consumer Duty validation – Ensuring your compliance team validates implementation, proving good client outcomes, compliance with Duty requirements, and an automated Consumer Duty Board Report.

Your Promise

Client service proposition – Is your investment, mortgage, insurance or retirement proposition robust in assessing investment service and product suitability and appropriateness, identifying client risk attitude, evidence governance and oversight and incorporating new technologies? (Which are all crucial in meeting UK regulatory and ongoing client needs)

Your Systems

Operations and service support – Operations and service support – Have you streamlined back, middle and front office administration tasks and Client Relationship Management (CRM) activities to interlink, control and share high quality data information, plus ensure financial, operational and cyber resilience?

Your People

Human Resource Development – How well have you complied with the SM&CR, training and competence, engaged staff and employees and employee engagement, incorporated technology and ensured you have the right people in the right place with the right skills, all of which are crucial to business success and building client loyalty and trust?

Analysing the results

Regulatory dashboardsThe main output is heat mapped regulatory dashboards and risk ratings along with a radar chart and key areas for focus and development |

||

Consumer Duty board reportAutomated Consumer Duty Board Report aggregates all data into one dynamic PDF report, so firms of all sizes gain a data driven strategic board report |

||

AI compliance chatbotMO compliance chatbot offers 24/7 AI-powered support, helping compliance officers with Model Office features, challenges, and key resources like FCA rules and regulatory papers. |

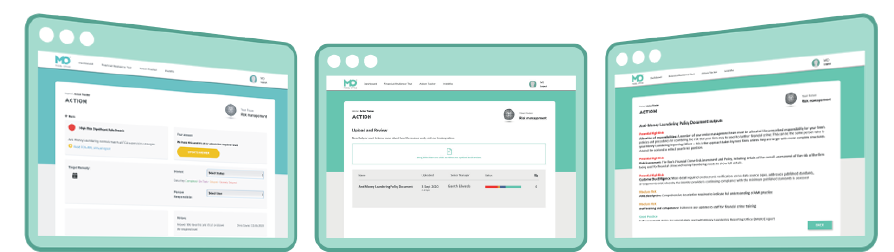

Action trackerAn Action tracker automates the audit report processes providing resources, alerts, and a compliance calendar to ensure the compliance team stay on track |

||

Dynamic steers and resourcesDynamic steers and resources to improve your scores to nudge your professional service development journey in the right direction are included |

||

Monitor AIAutomated client files reviews, compliance policy document audits and training and competence data driven dashboards with benchmarked compliance scores, ratings and resources to improve performance |